Opening a Branch Office versus a Subsidiary in Switzerland

When you want to open a company in Switzerland, the foreign parent company needs to decide whether to open a branch office or a subsidiary company (or perhaps it will simply have a foreign person as shareholder). Either way requires a similar company registration in Switzerland. By far, the subsidiary swiss company setup is the most common, but opening a branch office in Switzerland is starting to become more popular. When deciding which structure you want for your foreign company it is important to consider the purpose for doing business in Switzerland and the amount of independence the new office will have from its foreign parent company.

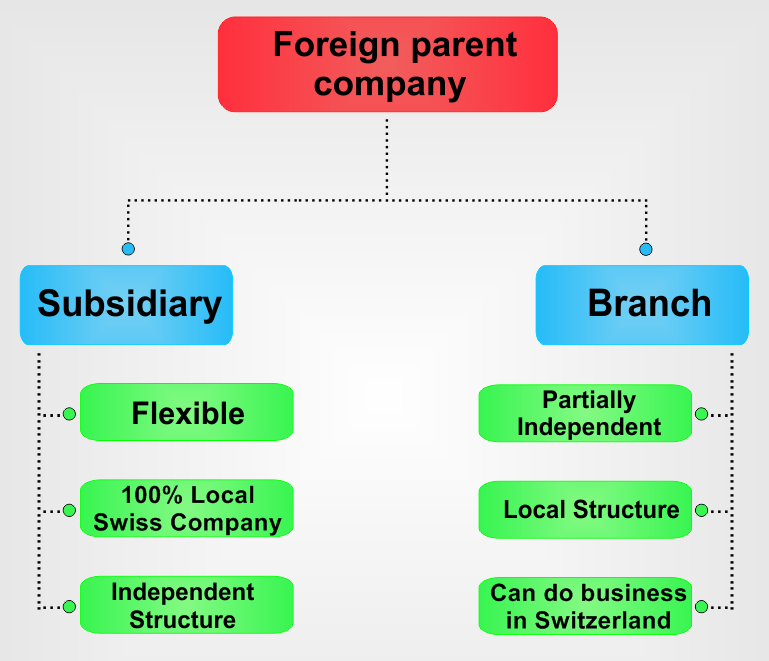

Both Swiss subsidiaries and branch offices are regulated by Swiss commercial law, but there are a few key differences (see diagram below).

The branch office in Switzerland

In Switzerland, a branch office is a satellite of the foreign parent company without a separate legal identity. This means the parent company is liable for the branch office.

Further, the Swiss branch office must operate in a way that represents the business of the foreign parent company. When it comes to income taxes, Swiss branch offices are treated like any other Swiss company, accept that a tax is not applied to gains transferred to the parent company, under specific circumstances.

Like a Swiss company, the Swiss branch office must have a registered office in the region where set up, at least one Swiss resident director and will be registered with the official Swiss Commercial Register (all of which we provide).

Like Swiss companies, Swiss branches can be incorporated under the usual several business forms. We can help determine which is best for you, but the public limited company (AG, SA) is the only form that provides shareholder anonymity.

What is a branch office in Switzerland?

In Switzerland, a branch office is a satellite of the foreign parent company without a separate legal identity. As such, the foreign parent company will be liable for the branch office’s activities and liabilities.

Further, the Swiss branch office must operate in a way that represents the business of the foreign parent company. When it comes to income taxes, Swiss branch offices are treated like any other Swiss company, accept that a tax is not applied to gains transferred to the parent company, under specific circumstances.

Like a Swiss company, the Swiss branch office must have a registered office in the region where set up, at least one Swiss resident director and will be registered with the official Swiss Commercial Register (all of which we provide).

Like Swiss companies, Swiss branches can be incorporated under the usual several business forms. We can help determine which is best for you, but the public limited company (AG, SA) is the only form that provides shareholder anonymity.

Advantages of a Swiss branch office

When making the decision between a branch office and subsidiary in Switzerland, the company’s managers should know that for a branch office, there is no need to pay in the usual minimum share capital and that Swiss branch offices generally benefit from lower taxes compared to a subsidiary.

If the parent company is domiciled in a foreign country which has a tax treaty with Switzerland for the avoidance of double taxation, the profits made from the operations of the Swiss branch office can be exempt from taxation under certain circumstances. Moreover, the Swiss branch office can be exempt from withholding tax which otherwise might be applicable to payments made to its parent company.

The main requirements when opening a branch office in Switzerland

When registering a Swiss branch, the representatives of the foreign company must provide a set of corporate documents to the local authorities, that are compulsory for the registration (naturally, we assist with advice on those requirements).

Finally, the Swiss branch must have a suitable trading name, which has to contain the name of the foreign parent company, plus the country of the foreign parent company, as well as the Swiss city/canton where the Swiss branch will operate.

What is a Swiss subsidiary?

Unlike the Swiss branch office, a Swiss subsidiary company is a company with a separate legal personality. The Swiss subsidiary company will be created respecting the Swiss legislation and it is considered an independent entity which limits the liability of the shareholders (no personal liability). As such, the Swiss subsidiary company is a separate and independent company with a majority of its shareholders and board of directors in the parent company. A subsidiary is usually registered as a Swiss limited liability company. Opening a subsidiary in Switzerland does not require special business permits.

Primary requirements for setting up a Swiss subsidiary?

When opening a subsidiary company in Switzerland, we assist the shareholders to provide the documents which will be registered with the “Swiss Handelsregister” in the official language of the canton where the company will be domiciled.

Swiss subsidiary companies must pay VAT (where applicable) and other corporate taxes, must be registered with the Swiss tax administration and, just like any other Swiss company, Swiss subsidiary companies must file an annual tax return and, quarterly VAT returns if VAT is applicable.

Unlike the Swiss branch, Swiss subsidiaries are allowed to register a trading name that differs from the foreign parent company.

Difference between a Swiss branch office and a Swiss subsidiary company

The Swiss branch office is a little easier to set up than the Swiss subsidiary company, but where liability is concerned, the subsidiary will not be affected by issues in the foreign parent company. Where taxation is concerned, both the Swiss branch office and the Swiss subsidiary are subject to corporate income tax from their income in Switzerland but in some cases the Swiss branch office may offer more tax advantages for the parent company.

There are no withholding taxes when transferring earnings from a Swiss branch office to its foreign parent company, whereas for the Swiss subsidiary company, the withholding taxes on dividends can be sent to its foreign parent company. Unlike the Swiss subsidiary company, liability issues concerning the foreign parent company will extend to its Swiss branch office.

Taxation is one of the few important differences between the Swiss branch office and the Swiss subsidiary and the main difference between the two is the tax base. The following need to be considered about taxation in Switzerland: (1) taxation is based on a three-tier system (federal, cantonal, and municipal levels); (2) at the federal level, the corporate tax ranges between 7.8% and 8.5%; and (3) Switzerland is made up of 26 separate cantons, each with its own cantonal tax rate;

With respect to both legal forms, it should be noted that Swiss subsidiary companies are considered domestic businesses and, as such, tax is levied on their global profits, while Swiss branch offices are only taxed on income generated in Switzerland. But this is simplified statement, because Swiss branches have other things to consider, like the taxes which have to be paid by its foreign parent company and whether or not the country of the foreign parent company has a double tax treaty with Switzerland (if it does, then the tax level is lower, and there are certain tax rebates and deductions which may apply).

If you need help in choosing between a Swiss branch and a Swiss subsidiary company, we can help you make the right decision.

Licensing requirements for the activities of foreign companies

One of the biggest issues to consider when to deciding between a Swiss branch and a Swiss subsidiary company are licensing issues. As mentioned earlier, branch offices are prohibited from conducting activities unrelated to those carried out by its foreign parent company, while Swiss subsidiary companies are free to operate in any activity.

When it comes to licensing, the autonomy of the Swiss subsidiary company over the Swiss branch is again apparent. For a Swiss branch office, the parent company must apply for the necessary license(s) for its Swiss branch, while the Swiss subsidiary company itself will be responsible for obtaining the license(s) it requires. In almost all cases, the licensing process must be completed with the Swiss authorities, despite the country jurisdiction of the foreign parent company.

We can assist you with licensing for your Swiss branch or Swiss subsidiary company.

Activities suited to Swiss branches and Swiss subsidiary companies

When choosing between the Swiss branches and Swiss subsidiary company form when expanding operations into Switzerland, it is important to consider the activities the Swiss operation intends to undertake.

For example, the Swiss branch form may be more suitable for financial operations such as: (1) banking activities; (2) insurance activities; and (3) reinsurance operations. Of course, this consideration is subject to the foreign parent company also undertakes these same activities. The primary reason a Swiss branch structure may be more suitable for these financial operations is that the legislation in these sectors is broadly regulated and the required license(s) are very similar across European countries. Additionally, there are several agreements in place between Switzerland and the EU related to financial services where specific licenses requirements are not needed because the Swiss branch office can benefit from mutual recognition.

On the other hand, the Swiss subsidiary company may be more suitable for trading, industrial activities and e-commerce, since these activities are not necessarily required to meet specific licensing requirements, and in this way, the Swiss subsidiary can adjust to the unique requirements of the Swiss market without depending on its foreign parent company.

Swiss AMF AG will provide you with information about the incorporation process, requirements, timelines and costs for either form of company.

Contact us for more information.